Business

Five Simple Steps to Dissolve an LLC Quickly and Easily

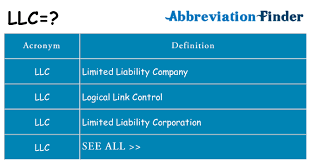

In order to properly dissolve an LLC, there are a few things that you will need. First and foremost you will need to have the forms filed with the state. These can typically be found in your legal directory at the county clerk’s office or online. You will need to also provide the name of the company (the LLC) and the owners (you). The next thing that you will need is proof that the name of the LLC is legally valid.

- The next thing that you will need to do is file a notice of intent with the county court. This not only tells the court that you have requested a court settlement, but it also provides them with the information that they will need to hear your case. This is commonly done through the same process as if you were filing a personal injury lawsuit.

- Once you have filed the notice of intent with the court, you will then need to register the business name of your LLC with the state. There is typically a small fee for this, but it is generally worth it for the protection of your business. Also remember that you will want to change the business name every so often to keep track of any changes to your LLC. It is a good idea to even have a staff member whose job it is to update the business name lists on a regular basis. Keeping up with such things as name changes is vital to your business future.

- Next you will want to figure out how much money you have in your business. Consider all aspects of your business including expenses and the profit margin of each trade and consider both revenue and expenses. Be sure to include revenue from any services or products that you offer to customers. Remember to leave some wiggle room to allow for potential losses.

- After considering all aspects, you will want to make sure your business is properly registered with the secretary of state. Depending on which state you are in, you may also want to consider the filing fees associated with such an application. You will want to hire an accountant or business attorney to help you with this process. Make sure they give you their opinion that it will be in the best interest of your company. In most cases, they can file paperwork and make all the necessary filings for you. Make sure you discuss everything with them beforehand.

Last, you will want to make sure that all of your LLC business assets are liquidated. You should liquidate any stock that is owned by your company and transfer out any personal property that belongs to you such as real estate properties and vehicles such as cars. Be sure that you do not pass any of these properties along to your family or friends as this can affect your ability to continue the business. You will have to report any sell of assets that you have made to your authorized officer of the company. This can only be done with written permission from the other parties involved.